Latest News

Find out the latest news and media coverage about Fox Symes.

Featured News

10 easy ways to make money on your lunch break

Aug 21, 2018

There are 200 hours a year where you could be earning extra cash — we’ve compiled some tips on how t

6 Thing You Should Never Put On Your Credit Card

Aug 14, 2018

Credit cards can be pretty handy, but only if they’re used wisely. However misuse and abuse them, an

Easy access to credit card results more unmanageable debt

Jul 16, 2018

I was sitting on the sofa at home with one eye on the TV and the other scrolling through Instagram w

The money-saving grocery shopping hacks that savvy women swear by.

Jun 29, 2018

With the ever-increasing cost of groceries burning a major hole in your pocket, here’s how to save m

A Guide To Last Minute Tax Savings Tips

Jun 26, 2018

The end of the financial year is almost here, which means it’s tax time once again. Check out these

The quickest ways to clear your credit card debt

Jan 15, 2018

Still can't believe how much you spent over Christmas? These tips will help you start financially af

One in four Australians would only be able to pay for an emergency costing $400 without using credit

Aug 16, 2017

ONE in four cash-strapped Australians say they only have enough money stashed away to cope with an e

Australians are relying on an inheritance to buy a home and pay off debt

Jun 22, 2017

MANY Australians are relying on an inheritance and are already working out how they will spend it, n

Shoppers using Afterpay explodes but some shoppers can’t pay back their debts

Jun 14, 2017

Shopping juggernaut Afterpay which allows customers to buy now and pay later is growing rapidly but

Most Australians gamble on a weekly basis to try and win money

May 26, 2017

A MAJORITY of Australians gamble every week and are blowing thousands of dollars a year in the hope

Australians are addicted to overspending on credit cards

May 24, 2017

CREDIT card users admit the temptation to splash out on plastic is far too enticing and many do it j

Wage stagnation blamed for increasing financial household pain

Feb 21, 2017

MANY households are struggling to afford their everyday expenses and blame the lack of wage growth

Most Australians are guilty of overspending particularly at Christmas

Dec 16, 2016

A MAJORITY of Australians admit they have a problem with overspending particularly at Christmas and

Wardrobe lessons from a reformed shopaholic

Nov 20, 2016

When Rachel White had a big corporate job in finance, she thought nothing of blowing a couple of g

Many Australians are lying about their financial situation to those close to them, alarming new stat

Nov 15, 2016

A MAJORITY of Australians are money-cheating on their partners or lying to family and friends about

Depressed about the Great Australian Dream

Oct 10, 2016

MANY aspiring homeowners believe their chance of owning their own slice or property is becoming furt

Homeowners take on too much debt and worry about repayments despite low interest rates

Sep 25, 2016

OVERCOMMITTED home loan customers are worried about meeting their repayments despite interest rates

Half NSW mortgagees concerned about making repayments, survey shows

Sep 04, 2016

Despite interest rates being at record lows, half of NSW mortgage holders are worried about not be

The new credit card law

Aug 31, 2016

Big companies, like airlines and taxis, are banned from slugging consumers with excessive credit and

Debt and money worries are causing stress and anxiety

Jul 04, 2016

Think of a deadbeat dad, and you probably imagine an unshaven bro permanently dressed in over-size

Aussies can’t afford to live on credit cards to pay everyday living expenses: new research

Jul 04, 2016

CASH-strapped Australians are having to resort to using their credit card to pay for everyday expens

Australian women are losing sleep over money.

Jun 22, 2016

Anxiety is a huge problem among Australian women and if the chorus of “me too” that erupts each time

How you can switch health cover at any time of year if you are not happy with your policy.

May 05, 2016

MAY is here but while a month has flown by since health funds hiked their premiums on April 1 there

Budget election and possible rate cut mean months of uncertainty

May 01, 2015

Tuesday's budget is unlikely to resolve uncertainty and lift consumer confidence. By John Collett.

Breaking the debt cycle: Your three-month plan

Jan 22, 2014

The New Daily speaks with financial experts and debt counsellors to get their insights on how to cle

Loan, sweet loan now a nightmare

Mar 25, 2012

UNREALISTIC expectations, huge mortgages and falling property prices are putting families at risk of

Fox Symes on Prime News “Country Debt”

Dec 05, 2010

Prime News "Country Debt" featuring our director Deborah Southon. Find out more about us and our cus

VIDEO: Fox Symes on Sky News “Debt Poll”

Dec 05, 2010

Fox Symes has been featured on many media channels including Sky News, A Current Affair and Today To

Pollies not answer on debt relief

Apr 29, 2007

John Howard and Kevin Rudd's competing economic claims have left voters cold, with many convinced th

Play your cards right

Feb 08, 2007

Being disciplined can help you manage credit card debt, writes James Bryce. The fun of Christmas an

Hooked on debt and living on borrowed time

Jan 25, 2007

Australians owe the rest of the world about $600 billion, writes Marc Moncrief. A new opposition lea

Rates doubt fuels home loss fears

Jan 14, 2007

THIS year is shaping up as one to fear for homebuyers according to a flood of new polling on househo

Rate rise may clip plasma’s pulling power

Nov 14, 2006

RETAILERS are nervously gearing up for what could be their toughest Christmas for many years, fearfu

Cut up the credit card

Nov 13, 2006

INTEREST rates are rising and Christmas is looming, so if you haven't worked out a budget already, n

Shoppers don’t do themselves credit

Oct 26, 2006

More than two-thirds of city workers had not been able to significantly reduce personal debt in the

Personal debt a major worry

Oct 09, 2006

AUSTRALIANS are becoming financially conservative amid rising interest rates and a higher cost of li

Christmas card tips

Jun 20, 2006

INTEREST rates are rising and Christmas is looming, so if you haven't worked out a budget already, n

Press Releases

More than 70% of Australians admit to overspending on everything from kid’s toys to alcohol

Nov 22, 2016

With the expensive Christmas period now almost upon us, new research reveals that the majority of Au

Half of all Australians hiding guilty ‘debt secrets’ from loved ones: latest Galaxy survey

Nov 14, 2016

Startling new research reveals the extent of Australia’s hidden debt shame. Half the country admits

One in three Australians cannot afford to own their own home: new Galaxy poll

Oct 10, 2016

For many people nationwide the great Australian dream of “owning your own home” is now all but out o

Galaxy Survey finds Australians are experiencing high stress over money and outstanding debts

Jul 05, 2016

NEW GALAXY SURVEY FINDS AUSTRALIANS ARE EXPERIENCING HIGH STRESS AND ANXIETY LEVELS OVER MONEY AND O

50% of Australians and families relying on credit cards to pay for food

Jul 04, 2016

HALF OF ALL AUSTRALIANS AND FAMILIES NOW RELYING ON CREDIT CARDS TO PAY FOR FOOD AND EVERY DAY EXPEN

Majority of Aussie workers struggling to afford everyday expenses on their annual wage

Feb 22, 2016

With wage growth currently at a record low, and incremental pay rises barely matching the escalating

Fox Symes Quarterly Debt Poll Research

Dec 15, 2015

The Fox Symes Quarterly Debt Poll is a national poll produced quarterly by GA Research for Fox Symes

Black Mark Warning - Debt expert warns new privacy laws may change the face of your credit history

Mar 04, 2014

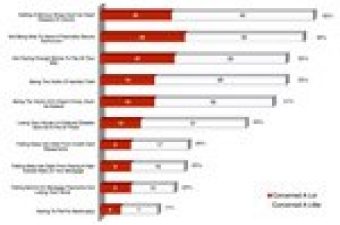

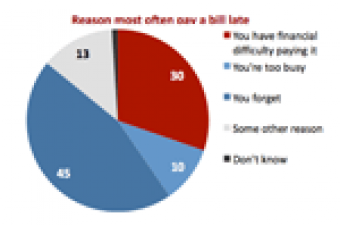

A Fox Symes Newspoll suggests that hundreds of thousand of Australian bill payers may have already b

Fox Symes Bill Paying Poll

Feb 13, 2014

This Newspoll survey was conducted by telephone over the period February 21-23 2014 among a national

Money Manager Media Coverage

Oct 23, 2002

Dollars & Sense was published on October 23, 2002 in the Sydney Morning Herald, the reporter was