Financial Hardship - Things You Need to Know

If you find yourself struggling with debt and unable to pay your bills, most banks and financial institutions offer financial hardship assistance to their customers. This means that they will consider your situation and offer ways to help with repayments or vary the terms of your loan if they feel it is appropriate.

Generally you can apply for hardship assistance in cases in which your financial circumstances have changed abruptly, for example because of illness or recent unemployment. Financial institutions are less likely to approve your hardship claims if you’ve simply over extended yourself or been living outside your means. Nonetheless, if you apply for hardship they must give you reasons for their decision to approve or refuse your application.

How do I apply for hardship?

If you are considering applying for a hardship variation you must first contact the lender or credit provider and ask to speak to the hardship officer. Some organisation might not have a hardship officer but will still put you in touch with a trained customer service officer. When speaking to the hardship officer provide them with details of your loan and inform them you want to change your loan repayments as they are no longer affordable. They will generally ask you to explain why you are having difficulties making payments, how long you think your financial problems will last and how much you can afford to repay. The credit provider must respond to your request in writing within 21 days letting you know the outcome of your hardship request, unless they have requested additional information.

What circumstances might be considered?

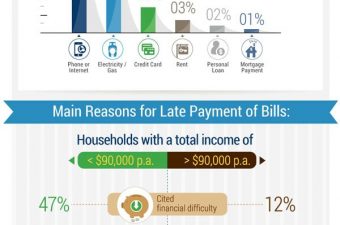

Creditors offer a range of financial hardship assistance for differing financial circumstances. These range from late payment assistance to considering permanent changes in financial circumstances. The severity of your financial hardship will determine the help available to you, for example unforeseen circumstances might prevent you from making a single repayment which could be deferred temporarily - alternatively long-term illness or injury might permanently affect your ability to make repayments which the creditor might take into consideration.

Some other events which might be taken into consideration for financial hardship claims include:

- Changes in income or expenditure

- Changes in employment status, including losing a job or having hours reduced

- Significant life events such as a relationship breakdown or death in the family

- Injury or illness

- Emergency event or natural disaster

How can financial assistance help?

Some of the ways your loan can be varied to help you with debt is to extend your loan period thus reducing the amount of your regular repayments, postpone your repayments for an agreed upon period of time or a combination of both. If you are considering applying for financial hardship assistance but find the prospect of negotiating with your creditors daunting, a financial counsellor may be able to help you with the negotiations.

What if my financial hardship claim is not accepted?

Depending on your situation it is possible that you will not be able to negotiate financial hardship assistance with all of your creditors. If this happens and you still cannot afford your repayments to your creditors there are alternatives for you to consider.

One such alternative is to enter into a debt agreement with your creditors. A debt agreement is a legally binding arrangement between you and your creditors in which they agree to accept a repayment amount over a set period of time, generally five years. Debt agreements are more formally binding than financial hardship variations and may be a more realistic option if you have multiple debts with different creditors that have gotten out of control.

Alternatively, if you are unable to reach a payment arrangement with your creditors and you can no longer afford to repay your debts bankruptcy might be the most appropriate option. Regardless of which option you think is most appropriate to your situation you should seek expert advice before you make your decision.

Fox Symes is the largest provider of debt solutions to individuals and businesses in Australia. Fox Symes helps over 100,000 Australians each year resolve their debt and take financial control.

If you are in debt and want to know more about the solutions available to you contact us on 1300 361 204.

Client Testimonials

What do customers think about Fox Symes? Hear what other customers are saying about us.